Newsroom

Caucus: Senator Brown, Reps. Hill, Luetkemeyer address CUs in final day of Caucus

The final day of NAFCU’s 2022 Congressional Caucus kicked off with Rep. French Hill, R-Ark., who sat down with NAFCU Senior Vice President of Government Affairs Greg Mesack to discuss housing finance issues.

The final day of NAFCU’s 2022 Congressional Caucus kicked off with Rep. French Hill, R-Ark., who sat down with NAFCU Senior Vice President of Government Affairs Greg Mesack to discuss housing finance issues.

Hill, Ranking Member of the House Financial Services Subcommittee on Housing, Community Development and Insurance, referenced the financial crisis of 2008, which he stated was never resolved, but flagged that he is still optimistic about the future of housing finance. When discussing the likelihood of House Republicans taking the majority back in this year’s election and how that would impact the affordable housing crisis, the Congressman responded that the United States has a “competitive mortgage system,” but noted that there is plenty of work to be done regarding subsidies and financial aid if he becomes Chair of the Subcommittee.

On the topic of interchange, Hill urged attendees to not be passive and “definitely talk about it aggressively and be direct,” when relaying to lawmakers the harm it would cause for small financial institutions, consumers and small businesses.

Later in the morning, Rep. Blaine Luetkemeyer, R-Mo., sat down with NAFCU Senior Director of Legislative Affairs Chad Adams in a fireside chat to discuss key issues facing Main Street businesses and everyday Americans. Luetkemeyer serves as Ranking Member of the House Small Business Committee.

Later in the morning, Rep. Blaine Luetkemeyer, R-Mo., sat down with NAFCU Senior Director of Legislative Affairs Chad Adams in a fireside chat to discuss key issues facing Main Street businesses and everyday Americans. Luetkemeyer serves as Ranking Member of the House Small Business Committee.

Regarding the worries he has heard from his constituents, Luetkemeyer stated that “from the standpoint of families, it’s inflation.” The Congressman stated that there was also a huge issue with the ability of businesses to hire and retain employees, sharing a personal anecdote about his own doctor’s office that is struggling to stay open.

Luetkemeyer reiterated his strong opposition to granting the Small Business Administration expanded direct lending authority, referencing its previous failed attempts. “They’ve proven that they don’t have the ability to do direct loans...the template is there, if you look at the PPP loans, banks and credit unions did a great job with it, we need to allow credit unions and banks to remain the direct lenders.”

NAFCU has worked with Luetkemeyer to stop this proposal and most recently the association met with Luetkemeyer in June to discuss the Congressman’s IMPROVE Act, a NAFCU-backed bill that would reform the SBA and prohibit the agency from engaging in any direct lending programs.

Of note, both Hill and Luetkemeyer discussed data privacy in the financial services industry. Hill stated that he does see a path toward comprehensive federal standards. Luetkemeyer during his chat echoed similar sentiments, “We all recognized that there needs to be an improvement in this area.”

On the CFPB’s proposed data collection rule and general oversight, Luetkemeyer expressed his frustration regarding the agency overstepping its regulatory authority, stating that “they continue to push the envelope. It’s our job as Congress to point out [to the CFPB] that you cannot do what you’re doing.”

The Congressman urged credit unions to write letters and take aggressive action if the CFPB were to enact the invasive section 1071 data collection rule, which NAFCU has sought a number of changes, sighting the significant compliance costs and the additional burden it would place on credit unions.

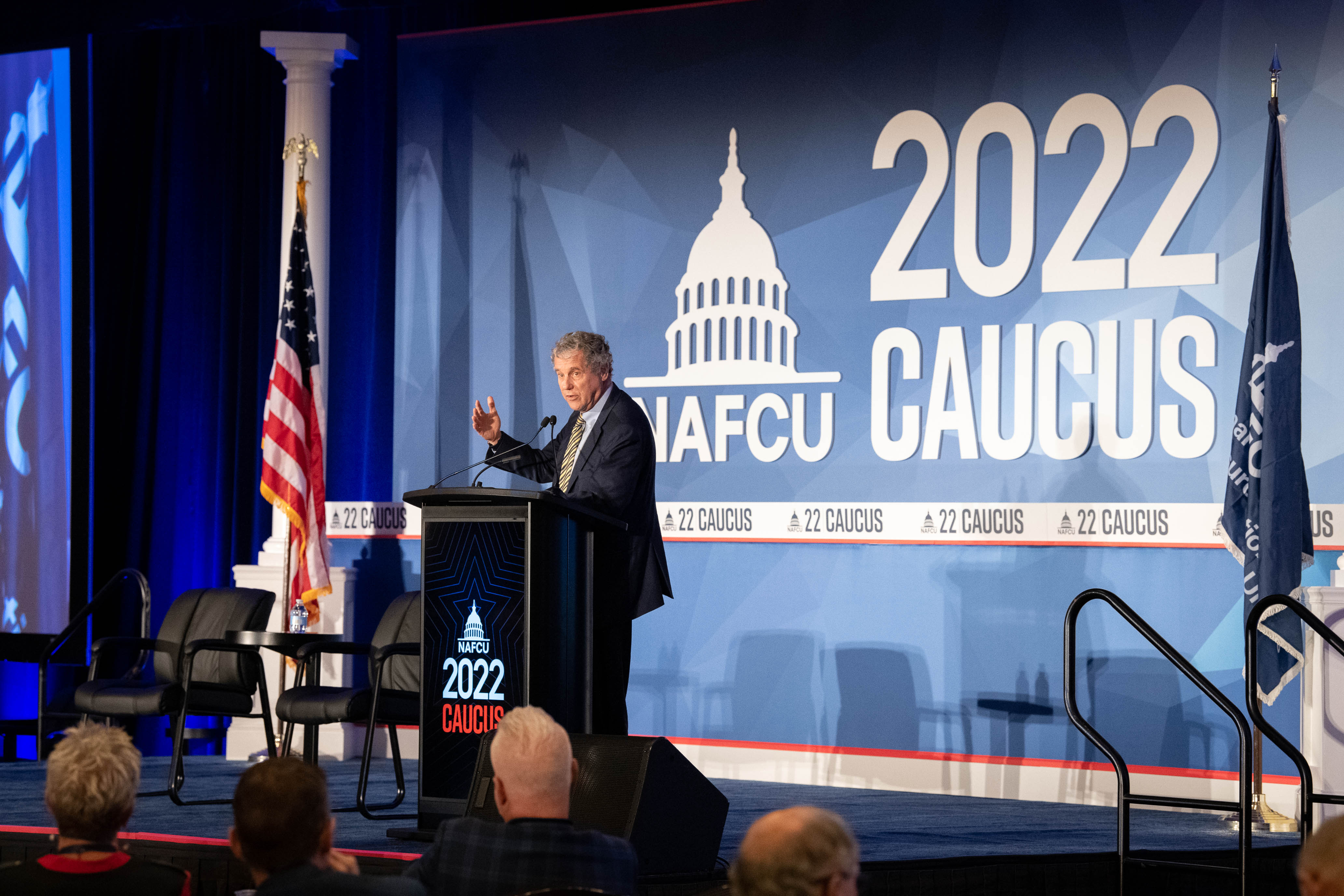

Closing out the list of Congressional speakers, Chairman of the Senate Banking Committee Sherrod Brown, D-Ohio, addressed credit unions highlighting his excitement as a repeat guest for NAFCU’s Caucus. Expressing gratitude toward the credit union industry, Brown exclaimed that credit unions “reach people that community banks and big banks don’t want to reach.”

Closing out the list of Congressional speakers, Chairman of the Senate Banking Committee Sherrod Brown, D-Ohio, addressed credit unions highlighting his excitement as a repeat guest for NAFCU’s Caucus. Expressing gratitude toward the credit union industry, Brown exclaimed that credit unions “reach people that community banks and big banks don’t want to reach.”

“I love the way you look out for the public interest, better than anyone else in the financial services industry,” added Brown.

Chairman Brown also pointed out the lack of consumer trust in big banks, mostly as a result of the alarming bank branch closures and their lack of support for small businesses. “These banks have closed branches in small towns, buying up stocks and focusing on CEO buybacks,” stated Brown. He also mentioned the strong partnership between his committee and the NCUA, a partnership he hopes will continue to strengthen.

NAFCU’s Congressional Caucus concluded yesterday. To catch up on previous sessions, take a look at Twitter with #NAFCUCaucus for previous live updates from the event.

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 The Evolving Role of the CISO in Credit Unions Listen On: Key Takeaways: [01:30] Being able to properly implement risk management decisions, especially in the cyber age we live in, is incredibly important so CISOs have a lot of challenges here. [02:27] Having a leader who can really communicate cyber risks and understand how ready that institution is to deal with cyber events is incredibly important. [05:36] We need to be talking about risk openly. We need to be documenting and really understanding what remediating risk looks like and how you do that strategically. [16:38] Governance, risk, compliance, and adherence to regulatory controls are all being looked at much more closely. You are also seeing other technology that is coming into the fold directly responsible for helping CISOs navigate those waters. [18:28] The reaction from the governing bodies is directly related to the needs of the position. They’re trying to help make sure that we are positioned in a way that gets us the most possibility of success, maturing our postures and protecting the institutions. Web NAFCU digital@nafcu.org America/New_York public

The Evolving Role of the CISO in Credit Unions

preferred partner

DefenseStorm

Podcast

AI in Action: Redefining Disaster Preparedness and Financial Security

Strategy

preferred partner

Allied Solutions

Blog Post

Get daily updates.

Subscribe to NAFCU today.