What Else is New With Marijuana Banking?; Another Credit Union ADA Victory; Help Us Help You!

A couple of weeks ago, I blogged about what's new with marijuana banking. Among other things, I provided an update on one credit union's ongoing efforts to become the first credit union chartered to support the marijuana industry and with a field of membership focused on cannabis groups.

In response to my post, several credit union industry players reached out to ask how many cannabis-friendly credit unions are currently handling marijuana-related accounts.

Who's Holding All That Cannabis Money?

Recent reports indicate that legal marijuana sales reached $9.7 billion across the seven states where recreational marijuana was legal and Canada in 2017. That number does not include California, which is projected to hit $3.7 billion in legal cannabis sales by the end of 2018, and $5.1 billion in 2019. Overall, despite continued federal prohibition here in the U.S., North American legal cannabis sales are expected to hit $24.5 billion by 2021.

Because the substance continues to be illegal under the federal Controlled Substances Act, marijuana businesses have remained challenged in obtaining traditional financial services but information from the Treasury Department indicates that more institutions are taking on these accounts.

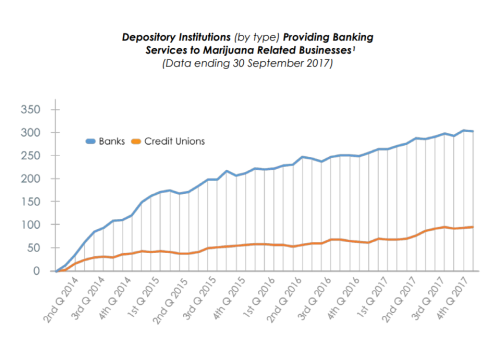

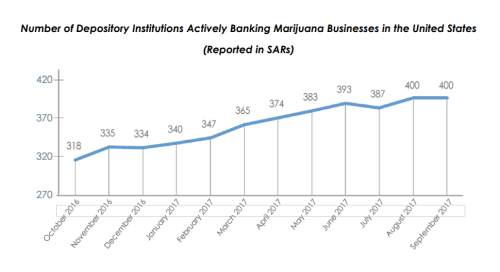

According to FinCEN's Marijuana Banking Update, based on Suspicious Activity Report (SAR) filings, around 400 depository institutions were actively banking marijuana businesses in the U.S. as of September 30, 2017. Less than 100 of those were credit unions, while the rest were banks. FinCEN's data shows that the agency received a total of 39,025 SARs using key phrases associated with marijuana-related businesses by the end September 2017.

Source: FinCEN Marijuana Banking Update (September 2017)

While the number of institutions serving marijuana businesses has more than tripled since 2014, federal data shows that only a small percentage of the 5,573 federally-insured credit unions across the country are reporting service to marijuana businesses. The growing industry will likely continue to be underbanked as long as cannabis continues to be federally illegal.

***

Third ADA Win for Credit Unions

On March 5, in another win for the credit union industry, a federal district court in Virginia granted a credit union's motion to dismiss an Americans with Disabilities Act (ADA) website accessibility suit. See, Carroll v. ABNB Federal Credit Union, No. 2:17-cv-521 slip. op. (E.D. Va. Mar. 5, 2018). NAFCU filed an amicus brief in this case; we have filed five briefs so far in support of our member credit unions.

As discussed in the latest issue of NAFCU's Compliance Monitor, for the past year credit unions have faced a growing litigation threat due to unclear website accessibility standards under the ADA. To date, NAFCU is aware that credit unions in at least 24 states have been impacted by ADA website accessibility claims.

In the latest case to be thrown out, the court found that "because [the plaintiff] has not shown that he (1) is a member of [the credit union], (2) that he is within [the credit union's] membership field, or (3) that he could become a member of [the credit union]," the plaintiff had not alleged a "sufficiently concrete injury in fact" necessary to show legal standing. See, Carroll v. ABNB Federal Credit Union, No. 2:17-cv-521 slip. op. at 8 (E.D. Va. Mar. 5, 2018).

The court's reasoning regarding the plaintiff's standing was consistent with two other recent decisions in virtually identical suits alleging website violations of the ADA by other credit unions. See, Griffin v. Department of Labor Federal Credit Union, 1:17-CV-1419, slip op. (E.D. Va. Feb. 21, 2018); Carroll v. Northwest Federal Credit Union, l:17-cv- 01205, slip op. (E.D. Va. Jan 26, 2018).

In addition, cases against two Texas credit unions (involving the same plaintiff) were dismissed on March 2. NAFCU also filed an amicus brief in support of one of those credit unions.

Please visit NAFCU's ADA webpage to learn more about this issue, and to keep apprised about what NAFCU is doing to fight for credit unions.

***

Monthly Research Survey: Help Us Help You!

NAFCU's Economic and Research Team conducts monthly surveys of NAFCU member credit unions in order to compile meaningful data reports that you can use to benchmark against your geographic and asset level peers. These survey results are also critical to NAFCU's advocacy efforts on your behalf to federal agencies, such as NCUA, CFPB and the Federal Reserve. Your participation helps us help you!

Today is the last day to share your voice on the topic of Financial Literacy & Community Outreach. We rely on your survey responses for our industry analysis and legislative advocacy efforts on behalf of all credit unions.

NAFCU members can participate in this month's Economic and CU Monitor survey with one of the options below:

- Online survey

- PDF file (please return by email to research@nafcu.org)

Deadline for Economic & CU Monitor survey: March 9, 2018