SAFE Act; NCUA on Interchange; Shameless Plug - GPS

Posted by Anthony Demangone

The SAFE Act questions appear to be gaining momentum here at NAFCU. Â That means that many of you are in the middle of the MLO registration process. Â We've heard one particular issue from many of you, and it concerns background checks. Â In short, many credit unions are starting to receive "criminal record" information about employees as a result of the MLO registration process. Â In many cases, the information is less than clear. Â Just what do regulators expect financial institutions to do with this information?Â

The following comes from the "preamble" of the SAFE Act final regulation.Â

âÂÂThe employing institution will be responsible for reviewing the criminal history background report once it is completed, and taking any necessary action based on the findings of this report, pursuant to the institutionâÂÂs policies and procedures, as required by this final rule. We note that the registrant will obtain a unique identifier during the registration process and not when the registration is complete.âÂÂ

You'll need to review your own policies and procedures to see what they say. Â Perhaps they are silent. Â If so, now might be a good time to think about how you want to handle any information you receive as a result of a criminal history background report. Â What will the process entail? Â Who will handle such issues? Â What will you do if the report is less than clear? Â

The good news is that regulators have given you the flexibility to handle this issue as you see fit. Â The bad news is that such flexibility comes with a price - you will need to sit down and make a business decision on how to proceed.

NCUA on Interchange. Â Â NCUA Chairman Debbie Matz sent this letter to the Fed regarding NCUA's views on their debit interchange regulation. The letter seems to say that the Fed's proposal will adversely affect those CUs under $500 million in assets. Â In the letter, NCUA notes that it didn't look at all foundational costs. Â The implication is that if your shop is over $500 million in assets, you can sit back, relax, and enjoy your berries and cream while watching Wimbledon on the tele. Â In any event, we think their analysis fell short, and we responded as such with this letter.Â

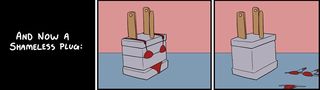

GPS.  The NAFCU Compliance Credit Union Compliance GPS is now available for purchase.  This is the manual we created for our own NAFCU Compliance School  Check out its table of contents, which should give you a good idea of whether the manual is a good fit.  A few things I'd like to point out:

- This is designed to be an electronic manual. Â There are links, links, and more links. Â If you want to print this puppy out, that's on you.Â

- It is available for purchase by NAFCU members and nonmembers alike. Â Just one manual is needed per shop - you can share amongst yourselves as you see fit after the purchase.

- We'll update this again for next year's Regulatory Compliance School. Â Attendees of the 2011 school already have this manual, so if your credit union sent someone to that school - there's no need to purchase it again this year.Â

Have a great weekend!