TILA-RESPA: Implementation Between Now and Then

Written by JiJi Bahhur, Director of Regulatory Compliance

With 10 months left to get compliant with the Truth-in-Lending Act/Real Estate Settlement Procedures Act (TILA-RESPA) integrated mortgage disclosures final rule, you may be wondering where the urgency is coming from to get started with implementation. I mean itâÂÂs not like you have the ability to comply early with the rule. In fact, the TILA-RESPA final rule goes into effect on August 1, 2015, and there is no provision within the rule that allows a credit union to comply early without violating the current TILA and RESPA rules. So whatâÂÂs the rush?Â

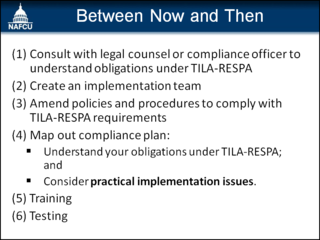

Well, there is PLENTY the credit union can be and should consider doing between now and then to ensure full implementation by August 1, 2015. Today, IâÂÂd like to share some slides that I created that run down some of the things you can be doing between now and then to get prepared.Â

It should be noted that, depending on your credit unionâÂÂs size and complexity, there could be more items the credit union should be addressing prior to the implementation date. This is something the credit union will have to consider and map out in its compliance plan.

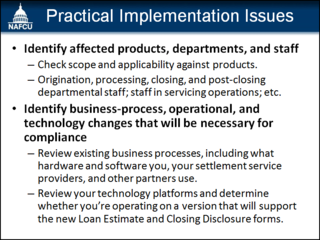

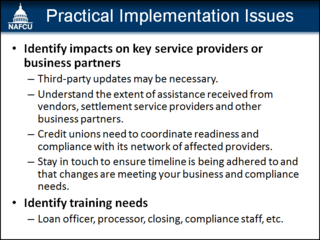

For more detail on what happens or what should be considered under each of the action steps on the slides above, take a look at section 16 â Practical Implementation and Compliance Issues â of the CFPBâÂÂs Small Entity Guide.

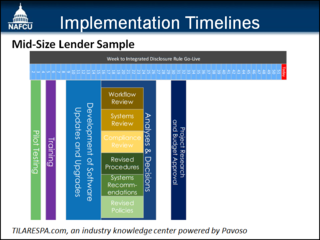

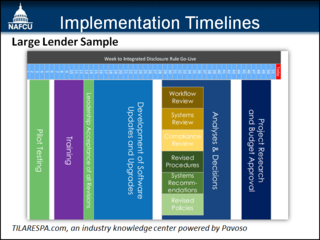

Before concluding, I thought IâÂÂd also share two timelines I found online that do a great job laying out a plan of attack for both a medium-sized and a large-sized lender. I did not make these timelines; credit goes to TILARESPA.com, an industry knowledge center powered by Pavoso.

The idea here is to get started so you donâÂÂt run out of time. TILA-RESPA is a time-sensitive regulation and the consequences for noncompliance or inaccuracies can be crippling to your credit union.Â

For more on TILA-RESPA, click here.