Updated URLA/Form 1003; Early HMDA Compliance Period for Ethnicity and Race Data Collection

Written by Elizabeth M. Young LaBerge, Senior Regulatory Compliance Counsel

Freddie Mac and Fannie Mae have issued an updated Uniform Residential Loan Application (URLA, also known as the Form 65 or Form 1003). The URLA can be used by creditors to ensure compliance with Regulation B (see 12 C.F.R. Part 1002, Appendix B) and is required under FreddieâÂÂs Seller/Servicer Guide and FannieâÂÂs Selling Guide.

The CFPB used its approval of the revised and redesigned forms, published in the Federal Register on September 29th, to also address the collection of applicant ethnicity and race information in advance of the new HMDA rules.

Early Compliance on Ethnicity and Race Data Collection Permitted

Generally, Regulation B prohibits credit unions from inquiring into an applicantâÂÂs race or ethnicity. However, Regulation B permits inquiries for monitoring purposes in connection with HMDA reporting. See, 12 C.F.R. ç 1002.5(a)(2). Thus, until HMDAâÂÂs new provisions are in effect, credit unions can only inquire into race and ethnicity to the extent required by the current HMDA provisions, unless otherwise permitted.

The BureauâÂÂs approval of the updated form cited that the revisions to HMDA do not require the collection of disaggregated race and ethnicity categories until January 1, 2018. However, in an effort ease the transition to new HMDA and provide space for the implementation of new policies and forms, the Bureau is permitting early compliance with the collection of disaggregated race and ethnicity categories. In the approval, the Bureau stated:

âÂÂAt any time from January 1, 2017, through December 31, 2017, a creditor may, at its option, permit applicants to self-identify using disaggregated ethnic and racial categories as instructed in appendix B to Regulation C, as amended by the 2015 HMDA final rule. During this period, a creditor adopting the practice of permitting applicants to self-identify using disaggregated ethnic and racial categories as instructed in appendix B to Regulation C, as amended by the 2015 HMDA final rule, shall not be deemed to violate Regulation B çâÂÂ1002.5(b). During this period, a creditor adopting the practice of permitting applicants to self-identify using disaggregated ethnic and racial categories as instructed in appendix B to Regulation C, as amended by the 2015 HMDA final rule, shall also be deemed to be in compliance with Regulation B çâÂÂ1002.13(a)(i) even though applicants are asked to self-identify using categories other than those explicitly provided in that section. The issuance of this Bureau official approval has been duly authorized by the Director of the Bureau and provides the protection afforded under section 706(e) of ECOA.â 81 Fed. Reg. 66930, 66931. (Emphasis added.)

For more information on the new disaggregated ethnicity and race categories, as well as new HMDAâÂÂs special transition rule for collecting ethnicity, race and sex information, NAFCU members can view this July 2016 Monitor Article.

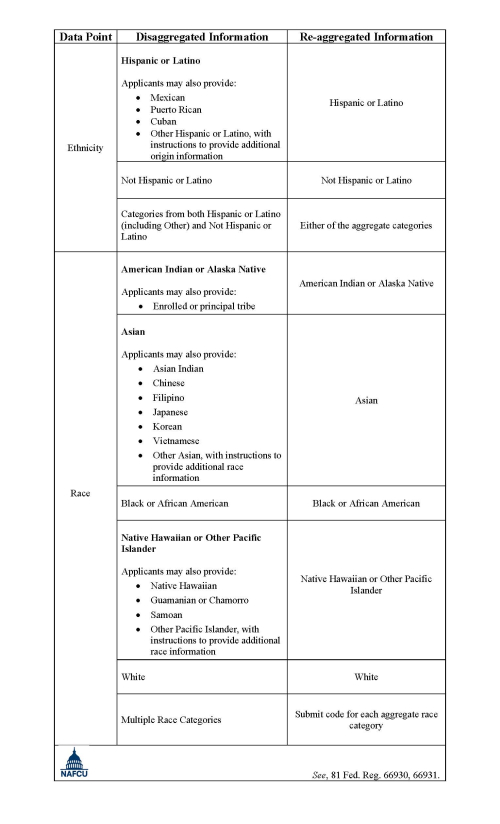

Credit unions complying early should continue to submit aggregated data throughout 2017, even though they are collecting data in a disaggregated form. The approval notice contains instructions on how to re-aggregate the information for submission. We have created a chart of the re-aggregation below for credit unionsâ convenience:

NAFCU Webcast â Save $100 by Registering by Thursday

Credit Union Vendor Management: Basic Concepts and Risk Mitigation Techniques

Live Webcast Thursday, October 13, 2016 Â | Â 2:00-3:30 p.m. ET

NAFCU's Director of Education Devon Lyon and Regulatory Compliance Counsel Benjamin Litchfield will discuss operational and compliance challenges posed by managing vendor relationships. Attend this webcast to pinpoint frequent vendor management trouble areas for credit unions, and learn agency supervisory expectations. Early-bird registration expires tomorrow!

Â