TILA/RESPA Loan Estimate: Projected Payments

Written by Victoria Daka, Regulatory Compliance Specialist

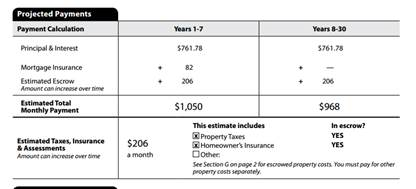

As the CFPBâÂÂs Truth-in-Lending/Real Estate Settlement Procedures Act (TILA-RESPA) Integrated Mortgage Disclosure ruleâÂÂs effective date of August 1, 2015 quickly approaches, we continue to receive questions relating to the Loan Estimate Disclosure â particularly, the âÂÂProjected Paymentsâ table. This table includes an Estimated Total Monthly Payment line item and an Estimated Taxes, Insurance, and Assessments line item. The Total Monthly Payment â not to be misconstrued with the colloquial definition â includes only the Principal & Interest, Mortgage Insurance, and Estimated Escrow amounts. The Taxes, Insurance, and Assessments line, which is the more complicated item in this table, is what this blog will focus on.

Â

Â

Â

Â

The Taxes, Insurance, and Assessments line item in this chart has led to some confusion because the rule contains multiple cross-references. The rule contains cross-references to the Ability-to-Repay/Qualified Mortgage rule and the definition of âÂÂfinance charge:âÂÂ

Â

âÂÂ(4) Taxes, insurance, and assessments. Under the information required by paragraphs (c)(1) through (3) of this section:

(i) The label âÂÂTaxes, Insurance & AssessmentsâÂÂ;

(ii) The sum of the charges identified in ç1026.43(b)(8) [defining âÂÂmortgage related obligationsâÂÂ], other than amounts identified in ç1026.4(b)(5) [credit loss insurance protecting the creditor], expressed as a monthly amount, even if no escrow account for the payment of some or any of such charges will be established...âÂÂ

This definition does not tell us much, other than that you need to check two other rules to determine what needs to be included in the "Estimated Taxes, Insurance, & Assessments" line. Section 1026.43(b)(8) says the following, and in and of itself cross-references the definition of âÂÂfinance charge:âÂÂ

Â

âÂÂ(8) Mortgage-related obligations mean property taxes; premiums and similar charges identified in ç1026.4(b)(5), (7), (8), and (10) that are required by the creditor; fees and special assessments imposed by a condominium, cooperative, or homeowners association; ground rent; and leasehold payments.âÂÂ

Â

Thus, anything listed in sections 1026.4(b)(7), (8), and (10) must be included in the âÂÂTaxes, Insurance, & Assessmentsâ section, as well as property taxes, fees and assessments imposed by condo or homeowners associations and things like ground rent and leasehold payments. Also note that while section 1026.4(b)(5) is included in the above mortgage-related obligation definition, it is specifically excluded from the definition of âÂÂTaxes, Insurance, & Assessmentsâ under section 1026.37(c)(4). ItâÂÂs no wonder that this item is a struggle! Here are the relevant sections of 1026.4(b) cross-referenced in section 1026.43(b)(8):

Â

âÂÂ(b) Examples of finance charges. The finance charge includes the following types of charges, except for charges specifically excluded by paragraphs (c) through (e) of this section:

Â

[â¦]

Â

(7) Premiums or other charges for credit life, accident, health, or loss-of-income insurance, written in connection with a credit transaction.

(8) Premiums or other charges for insurance against loss of or damage to property, or against liability arising out of the ownership or use of property, written in connection with a credit transaction.

[â¦]

(10) Charges or premiums paid for debt cancellation or debt suspension coverage written in connection with a credit transaction, whether or not the coverage is insurance under applicable law.âÂÂ

Thus, any of these three items are included in the âÂÂestimated taxes, insurance, and assessmentsâ if it is âÂÂwritten in connection with a credit transaction,â and if it is âÂÂrequired by the creditorâ as set forth in 1026.43(b)(8).

Keep in mind, for those that are still working through this rule the CFPB created the sample forms, the Guide to Forms, and a Small Entity Compliance Guide for the TILA/RESPA integrated disclosures rule that may be a helpful resource for your staff. In addition, for our members, NAFCU has a mortgage page that would also be of assistance to your staff.Â