Plain Writing Act of 2010; NAFCU Blog Search

Written by Steve Van Beek

Usually, the laws we discuss on the blog are ones that cause additional headaches and issues for credit union compliance officers. Â Today we wanted to focus on a law that is intended to ease the confusion surrounding the laws, regulations and guidance impacting credit unions. Â I'm not sure of a great mechanism to enforce this law but at least it is a step in the right direction.

Plain Writing Act of 2010. Â On October 13, 2010, President Obama signed into law the Plain Writing Act. Â In short, the law requires federal agencies to use clear, concise information when communicating with the public to ease understanding of the numerous regulations pumped out from Washington on a daily basis. Â Stop laughing.

One of the requirements of the law is that federal agencies - including NCUA and the CFPB - need to maintain Plain Writing Act webpages on their websites as well as file annual reports with Congress (the first annual report was due April 13, 2012). Â Â

- The CFPB's Plain Writing Act webpage is here and their April 13, 2012 report is here.

- NCUA's Plain Writing Act webpage is here and their April 13, 2012 report is not available yet (at least it hasn't been posted on their website as of this morning).  Â

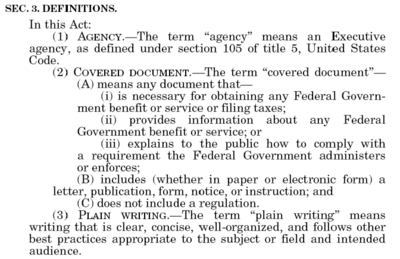

Not so Fast.  Now, you may be very excited to find out that the federal agencies now have a legal requirement to make their regulations clear and straightforward.  Unfortunately, this is the real word so there are exceptions.  The agencies need to use Plain Writing for "covered documents."  The definition of "covered documents" specifically excludes regulations. Â

While this exception might make sense for very, very technical regulations from the Environmental Protection Agency, for example, it shouldn't give the NCUA and the CFPB free rein to continue to blast out pages and pages of completely indecipherable regulatory requirements without making their best efforts to ensure the information is readable. Â

Soap Box  Credit unions need to make these efforts in their communications with their members.  Why shouldn't the federal agencies have to at least take efforts to do the same? The more clear and straightforward the requirements the higher the compliance rates and the greater the consumer/member protection. Â

Hopefully the CFPB and NCUA start to grasp this concept.  It just isn't possible for credit unions - of any size - to read and translate every piece of information from the regulatory agencies (including the regulations themselves) from *regulator speak* to plain English.

***

Blog Search Bar. Â On Friday, we announced the new Blog Search Bar. Â The post includes the process for conducting a search and sorting your results - by either "best match" or "most recent." Â

To use the search bar, go to the main NAFCU Compliance Blog page and look to the upper left-hand side.  We accidently put the right-hand side in the initial blog last Friday and, well, you can tell our readers are compliance officers as we were quickly informed of our mistake. Â

If you didn't try the search bar on Friday, give it a try today (more detailed instructions here). Â We hope it cuts down on some of the frustration of tracking down an old blog post or other information. Â Â Â