FinCEN Regulatory Impact Assessment on CDD Proposal; CFPB Issues Letter on TRID Enforcement and Liability

Written by Brandy Bruyere, Director of Regulatory Compliance

I hope everyone had a wonderful New Year! After a couple of long holiday weekends, I thought we would start off 2016 with FinCEN/the BSA and a recent development relating to TRID. Remember that time FinCEN proposed explicit customer due diligence requirements for beneficial owners of legal entities? These rules were originally slated to become final this past summer, but so far, FinCEN has not finalized the proposal. According to the Department of Treasury's fall rulemaking agenda, the proposal could be finalized as early as this month but when NAFCU reached out to FinCEN to confirm, an agency spokesperson indicated that they are still in the comment analysis stage.

On December 23, FinCEN released its Regulatory Impact Assessment (RIA) for this proposed rule which highlighted costs of the rule compared to benefits using an upper bound for costs based on estimated and hypothetical values. Overall, FinCEN concluded that so long as the CDD proposal would reduce illicit by a minimum of 0.57 percent annually between 2016 and 2025, the rule would achieve [a] positive net benefit. Here are some noteworthy items from FinCEN's costs analysis.

Staff time for completing CDD requirements (page 5) - FinCEN estimates that it would require, on average, 20 minutes to fulfill the beneficial ownership identification, verification and recordkeeping requirements in the proposal.

Annual costs to small institutions (page 6) FinCEN estimates that the proposal would result in a cost to a small bank of between approximately $2000 and $4000 per year at account opening

Training (Page 7) FinCEN said the following about the costs associated with training staff to implement the proposal: Assuming that a small financial institution has 125 employees and that the training would take one hour, and applying the wage assumptions used in the RIA, this would result in an estimated cost of between $1250 and $2500, depending on the percentage of employees trained, for the first year that the rule would be in effect The amount of necessary training would decrease thereafter. (Emphasis added.)

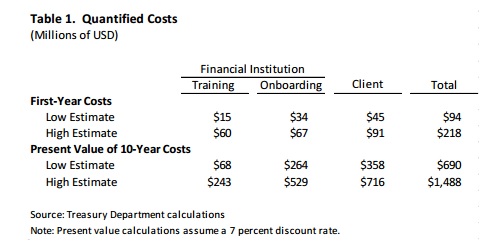

Here is a table provide on page 10 summarizing FinCEN's estimates for total costs for training across all institutions, in the millions:

Note, the client column represents estimated costs to the member due to increased time to open accounts and similar impacts.

Information Technology costs (page 25, footnote) FinCEN included some specifics on reported information technology costs associated with the proposal. One large bank estimated IT costs to be about $20 million, a mid-sized bank estimated these costs to range from $3 million to $5 million, and a small credit union estimated its costs would be between $50,000 and $70,000.

The RIA goes on to explain how the benefits of the CDD proposal were evaluated, noting the difficulty in placing a qualitative dollar amount of benefit to compare to costs.

***

CFPB Issues Letter on TRID Enforcement and Liability. In response to a letter from the Mortgage Bankers Association, last week CFPB Director Richard Cordray sent this letter discussing TRID liability. Here are some excerpts with hyperlinks included:

As with any change of this scale, despite the best of efforts, there inevitably will be inadvertent errors in the early days. That is why the Bureau and other regulators have made clear that our initial examinations for compliance with the rule will be sensitive to the progress industry has made all of the regulators have indicated that their examinations for compliance in the first few months of implementing [TRID] will be corrective and diagnostic, rather than punitive.

In addition to the cure provisions contained in the rule the Truth in Lending Act itself contains provisions for the correction of errors. These provisions continue to apply to the integrated disclosures. For example, TILA has long permitted creditors to cure violations, provided the creditor notifies the borrower of the error and makes appropriate adjustments to the account before the creditor receives notice of the violation from the borrower. 15 U.S.C. 1640(b). Similarly, TILA contains an exception from liability for unintentional errors, subject to certain conditions. 15 U.S.C. 1640(c).

Furthermore, while [TRID] does integrate the TILA disclosures with the disclosures required under [RESPA], it did not change the prior, fundamental principles of liability under either TILA or RESPA. Therefore, for non-high-cost mortgages:

There is no general TILA assignee liability unless the violation is apparent on the face of the disclosure documents and the assignment is voluntary. 15 U.S.C. 1641(e).

By statute, TILA limits statutory damages for mortgage disclosures, in both individual and class actions to failure to provide a closed-set of disclosures. 15 U.S.C. 1640(a).

Formatting errors and the like are unlikely to give rise to private liability unless the formatting interferes with the clear and conspicuous disclosure of one of the TILA disclosures listed as giving rise to statutory and class action damages in 15 U.S.C. 1640(a).

The listed disclosures in 15 U.S.C. 1640(a) that give rise to statutory and class action damages to not include either the RESPA disclosures or the new Dodd-Frank Act disclosures, including the Total Cash to Close and Total Interest Percentage.

Accordingly, the Bureau believes that if investors were to reject loans on the basis of formatting and other minor errors, as you indicate has been occurring, they would be rejecting loans for reasons unrelated to potential liability associated with [TRID]

The full letter is available here: CFPB response to MBA TRID letter

NAFCU continues to call on the CFPB to provide greater clarity on TRID. While this clarification on the scope of TRID liability is a step in the right direction, NAFCU hopes that the CFPB will follow this course into 2016 by more proactively resolving ambiguities raised by the industry in official guidance.

Palate Cleanser. We took Nolan to Ohio for the holidays, he had a great time. He also got to see first hand how in mommy's hometown, tractors are much more versatile than here in the DC suburbs - they can take you to the local convenience store! In a somewhat related note, my high school alma mater's annual tradition made the local news last spring, when I shared it with some folks here in DC they thought it was an article from The Onion but nope, this is a real news story about "drive your tractor to school" day. Enjoy!